The last 72 hours have been stressful for many founders; especially SVB founders. The collapse of SVB is a big deal and will likely cause ripple effects across the startup and venture capital ecosystem.

SVB isn’t just any bank. It’s the startup bank. It was the 16th largest bank in the United States at the time of its failure.

Fractional Reserve Banking

Banks are only required to keep a certain amount of cash available for withdrawals and loan out the rest of the deposits. All developed nations use Fractional Reserve Banking principles to drive growth and stimulate the economy.

The conventional view is that banks are required to have a reserve requirement of 10%. In simple terms, if a bank has $1B in deposits, they can lend out or invest $900M.

This is a non-issue typically. All banks maintain small amounts of deposits because bank runs are highly unlikely and most people aren’t going to withdraw all at once.

The problem with SVB, however, is what they did with the amount they invested.

Risk Management Failure

SVB provided venture debt to startups. This allowed startups to expand their balance sheet in a non-dilutive way and have access to more capital. As inflationary pressures increased, Central Bank had no choice but to raise interest rates fast. This caused asset prices to compress and access to capital became scarce. VCs pulled back on deploying capital. Startup burn rate continued at the same pace. And deposits into SVB started to shrink.

Combining that with SVB investing short-term deposits into longer-term, fixed-rate, assets exacerbated the whole problem.

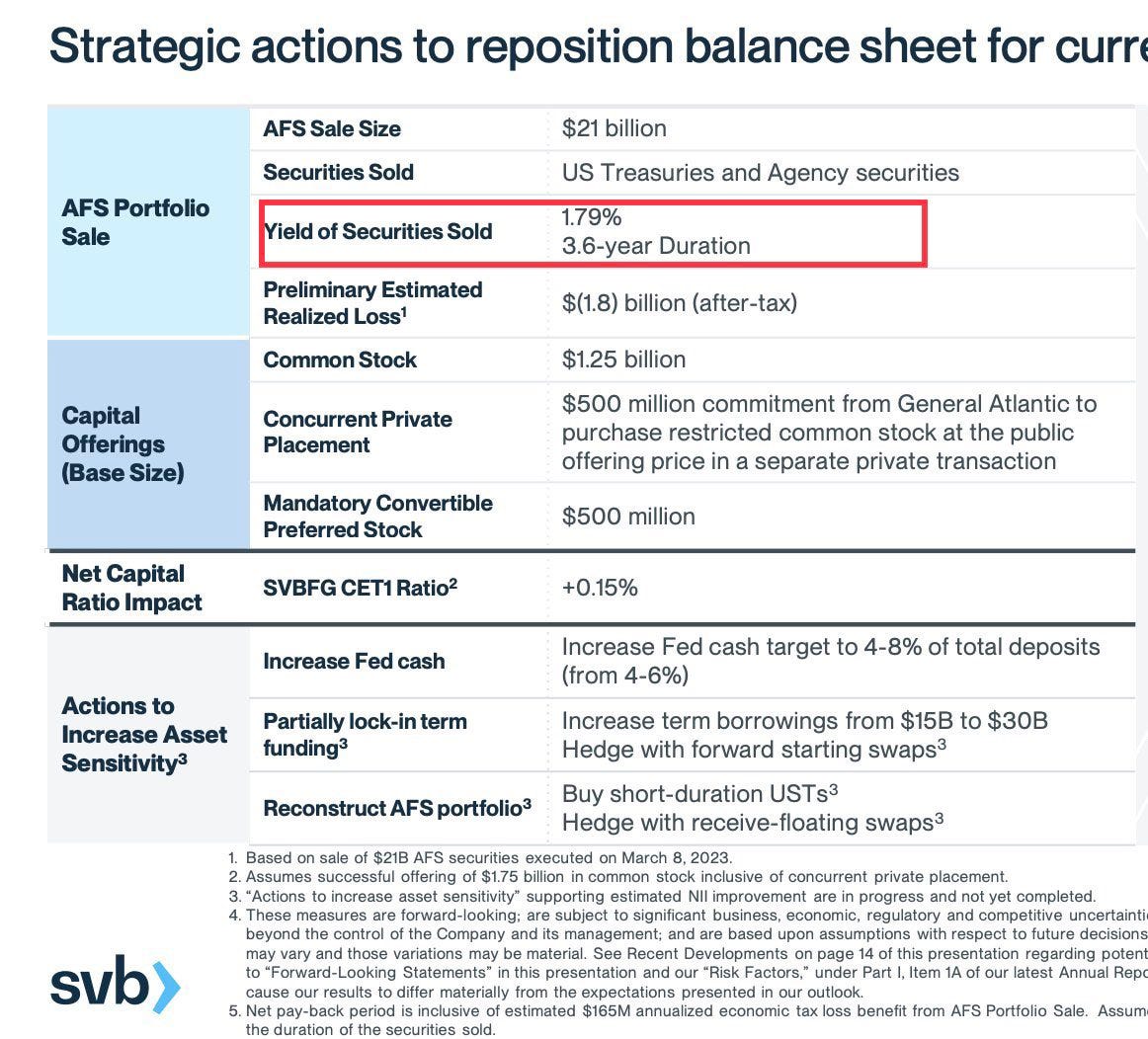

The Fed has raised interest rates by 450 bps in the last 11 months to fight inflation. SVB took an impractical position against the Fed and didn’t underwrite against interest rate risk. They bought tens of billions of dollars of bonds that had a 3.6 year term duration with a 1.79% yield.

SVB felt a tight squeeze; startup funding was drying up and withdrawals increasing. As liquidity concerns came into the spotlight, it needed to come up with cash fast, so it sold some of the securities and took a massive $1.8B loss. This led to a scramble to raise equity capital. And when that initiative failed, it caused panic in the market. Leading to 60%+ drop in SVB’s stock the following day followed by the fastest bank run in history.

By Friday morning, FDIC seized the bank, leading to a total collapse.

What Now?

SVB played a key role as an infrastructure-style institution. Its failure impacts the entire startup ecosystem. Not just SVB clients and customers, but many others.

If you don’t bank with SVB, your vendors do. The software you use to process payroll might use it. The e-commerce store you run might use it. The list goes on.

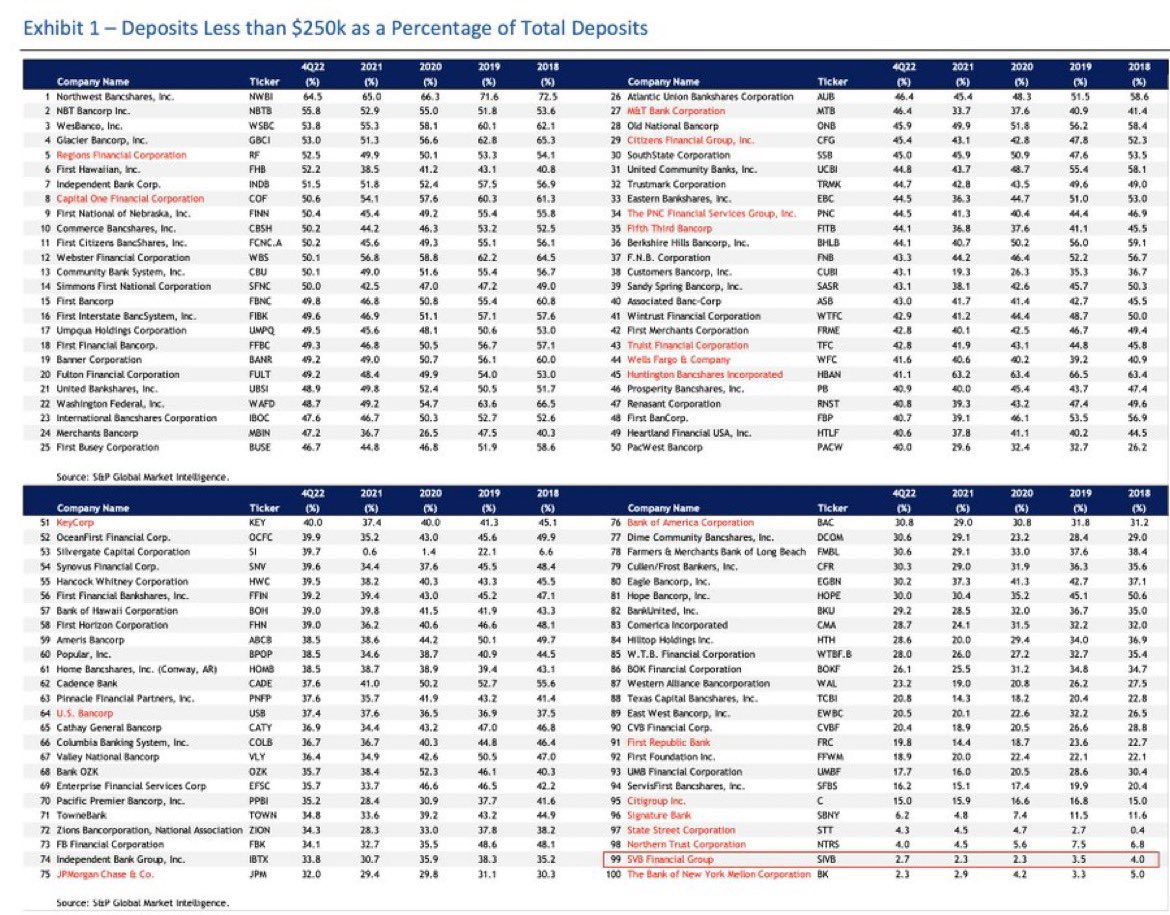

And perhaps the biggest issue is that FDIC only covers depositors with $250K or less in deposits, nothing above that. And SVB only had 2.7% of depositors that meet that threshold.

I’ve come across a few good links and resources that are being updated in real-time by founders, employees and the broader startup community.

If you’re an SVB customer, review this:

FDIC coverage - read this first

If you’re a non-SVB customer:

Your vendors should reach out to you if they’re impacted and provide updated banking info for your AP.

If you’d like to proactively reach out to your vendors, then look in your AP to see who banked with SVB. The Silicon Valley Bank routing numbers are 121140399 and 121145145.

If your AR is dependent on SVB customers, then proactively reach out to your client and check in. You may need to work out a payment plan or extend terms.

Here’s my general advice (and please note that I’m not a financial advisor and not legal counsel):

FDIC limit is $250K at any given bank (not just any account). If you have $2.5M in 10 accounts at the same bank, then you’re still only insured up to $250K. It doesn’t hurt to have a few banking relationships in place. Ideally one or two of them should be a large and safe institution (e.g. JP Morgan Chase, Bank of America, etc).

Expanding beyond FDIC-covered limits, you should start thinking about treasury management for your business. Look for ultra-short term T-bills and money market funds. They provide immediate liquidity and are backed by US govt.

My team is here to help if you need anything or have any questions. Please email founders@financewithin.com and we’ll respond quickly.