Merchandising Is Not a One-Size-Fits-All Strategy

Why assortment must match channel

When brands start to scale, the temptation is to standardize everything: product assortment, pricing, creative, packaging, etc. It feels operationally cleaner. But what’s clean for your ops team can feel chaotic for your customer.

This is especially true when it comes to merchandising. The assumption that what works in DTC should work in retail (and vice versa) is wrong and it’s expensive. Every channel has its own psychology, mechanics, and economics. Treating them the same ignores an essential truth in commerce: context drives behavior.

This essay is about that context. And about why great brands are architects of thoughtful assortment, based on where and how the customer is shopping.

Cognitive Load and the DTC Paradox

DTC is a minimalist game. Your website is a funnel, not a shelf. The customer isn’t there to browse for 20 minutes. They’re trying to solve a problem, fulfill a want, or respond to a moment of inspiration. The more decisions you ask them to make, the fewer they actually do.

Behavioral psychology calls it the “paradox of choice.” More options sound better in theory, but in practice, they overwhelm, confuse, and reduce conversion. You see this in DTC brands with 50+ SKUs on their PDPs, dropdowns for every possible variation, and a homepage that looks like a crowded endcap.

Conversion rates drop. Bounce rates climb. The customer gets distracted, second-guesses their decision, and exits.

Notable DTC brands built themselves on tight, highly edited catalogs:

Sol de Janeiro led with a single hero product (Brazilian Bum Bum Cream) which became a breakout hit through scent, packaging, and community buzz. That hero SKU drove customer acquisition and laid the foundation for cross-sells into body wash, fragrance, and more.

Ritual began with a single woman’s daily multivitamin (18+), anchoring its brand around transparency and traceable ingredients.

Hims entered the market with a tightly focused lineup targeting men’s hair loss and ED. Just a few SKUs, high stigma, high intent, and strong margin. Driving customer acquisition through a simple, needs-based funnel.

Each of these brands made the same strategic decision: reduce cognitive friction at the top of the funnel to increase conversion. That’s the game in DTC. Clarity converts.

The Strategic Role of a Hero SKU

When we advise brands, we almost always push them to identify and focus on a “hero SKU.” This is the product that drives new customer acquisition… often responsible for 60–70% of first purchases.

A hero SKU simplifies everything:

Ad creative becomes more focused

Landing pages are tighter and more optimized

Attribution improves because variables are constrained

Inventory planning gets more predictable

It becomes the tip of the spear: a product that represents the brand, solves a clear customer need, and is priced to convert.

But it’s not just about acquisition. A strong hero SKU opens the door for higher lifetime value. Once trust is built and the product is in-hand, you earn the right to cross-sell.

This wedge strategy is powerful:

Acquire with a hero SKU

Retain and grow via complementary SKUs

Sequence additional categories based on data and timing

Smart DTC brands build their catalog around the hero SKU (not on top of it).

Retail Is a Discovery Channel

Everything changes in retail. The psychology flips compared to DTC.

In a retail store, the customer wants to browse. They want to touch, compare, pick up one product and put another down. It’s a physical, visual experience. Assortment and variety become an asset. It enables discovery.

Retailers don’t want your best-selling SKU alone. They want a portfolio that creates a destination on the shelf or endcap:

Enough variety to create visual blocking

Enough depth to support promotional moments

Enough units to justify shelf real estate

If you show up with a single SKU, you’re just taking space. If you show up with a brand block, you’re owning space.

Retail buyers aren’t just thinking about your brand. They’re thinking about category mix, price laddering, promotions, foot traffic, and shelf economics. A brand with a 10-SKU lineup in beverages can give them:

Low sugar SKUs for the wellness customer

Functional SKUs for performance

Classic SKUs for nostalgic buyers

Seasonal flavors to rotate

That kind of assortment matters because it helps the retailer merchandise the shelf and not just stock product for the sake of.

The Dangerous Middle: Channel Copy-Paste

This is where I see most brands get it wrong. They try to run the same playbook in DTC and retail. But copy-pasting your retail line into your DTC store (or vice versa) usually backfires.

We’ve seen brands push their full wholesale line onto their website, thinking “more SKUs = more sales.” But DTC isn’t Costco. It’s not a treasure hunt. When assortment grows faster than merchandising logic, the experience breaks.

Visitors get lost in product pages

Navigation gets bloated

Marketing teams struggle to position everything at once

CAC goes up. Conversion drops. And your core product (the one that built your brand) gets buried.

On the other hand, launching retail with just a hero SKU can be a misstep. If you’re a bar brand, one flavor isn’t enough. If you’re a skincare brand, a single cleanser won’t earn you an endcap. Retailers want range. They want adjacencies. They want enough velocity and margin to justify resets and promos.

Building the Post-Purchase Path: Cross-Sell and LTV Sequencing

DTC is about designing LTV. The real game is building an intelligent post-purchase experience that turns that hero SKU buyer into a multi-category loyalist.

The biggest mistake in retention marketing? Pushing everything at once. Just because someone bought one product doesn’t mean they’re ready to see the full catalog. Great brands sequence and create “experience vectors.”

Day 1–14: Reinforce value of original purchase

Day 15–30: Recommend complementary product (based on usage or need)

Day 30+: Introduce subscription, bundling, or deeper category expansion

The smartest brands build LTV like a curriculum. First you enroll the customer. Then you graduate them to higher levels of ownership.

This can be reflected in:

Email flows

Retargeting logic

Loyalty programs

On-site PDP recommendations

When you treat catalog as a narrative (anchored by a hero and supported by sequenced expansion), you create velocity without chaos.

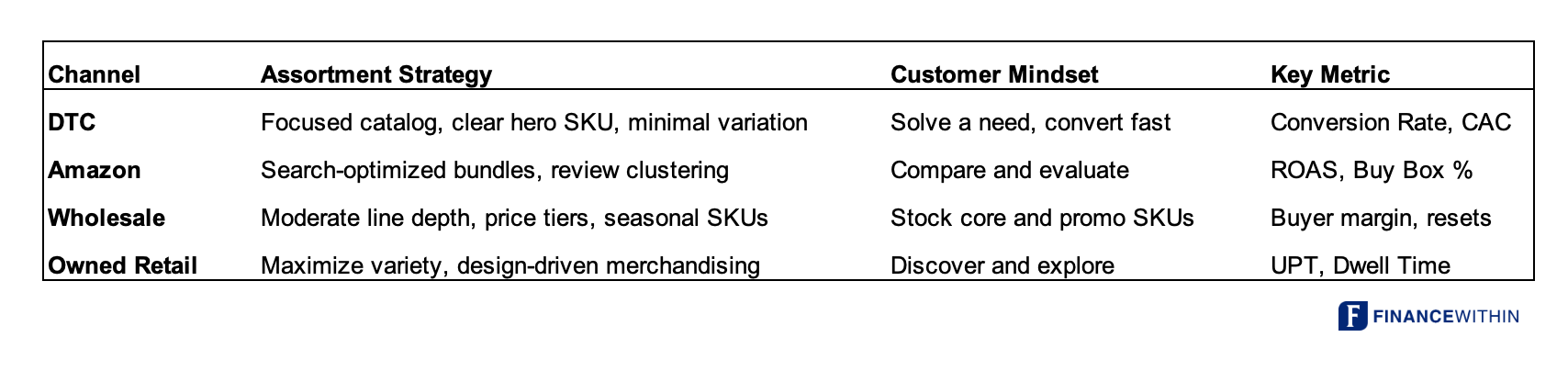

Assortment Strategy by Channel

Your assortment should always match the psychology of the channel. Let’s distill this into a clear, practical, and operator framework:

Brand Examples

Olipop

DTC: Pushes 1–2 hero SKUs (Classic Root Beer, Vintage Cola) with bundles designed for first purchase.

Retail: Has 12+ flavors to create shelf-blocking, seasonal rotation, and in-store discovery.

Result: Fast DTC CAC payback + strong retail velocity growth across Whole Foods, Sprouts, etc.

Ritual

DTC: Laser-focused on one multivitamin per customer type (Women 18+, Men 50+, etc.).

Post-purchase path: Gradually introduces protein powders, pre/post-natals, and bundles via email and SMS.

Result: Clear entry point + sequenced LTV roadmap = scalable and capital efficient.

Touchland

Retail: Strong in-store merchandising through color assortment and visual display.

DTC: Uses hero SKU bundles to drive gifting and seasonal promos with limited-time drops.

Result: High brand recognition and pull-through across both channels, driven by channel-specific merchandising.

How to Design a Channel-Aligned Catalog

If you’re building an omnichannel brand, here’s how to approach catalog design:

Start With the Hero SKU

What product drives the clearest, cleanest new customer acquisition? Build your DTC playbook around it.

Build a Layered Roadmap

Introduce second and third SKUs based on:

Customer lifecycle

Usage frequency

Logical adjacency (e.g., serum after cleanser, creamer after coffee)

Design for Retail Depth

Curate a line that supports shelf presence:

Think in planograms

Use size and flavor/variety to create vertical and horizontal blocking

Offer exclusives or retailer-specific bundles

Audit Each Channel Separately

Ask yourself:

What’s the customer’s mindset here?

What merchandising elements support that mindset?

What assortment tells the best brand story in this context?

Quality Merchandising Unlocks Real Value

Assortment is about unlocking demand across the right channel at the right time. Great merchandising is rooted in empathy for how customers shop.

For DTC, focus and frictionless conversion win. For retail, depth and discovery drive velocity.

But the magic is in the orchestration. Knowing when to pull which lever, and never assuming what works in one channel will translate to another.

In a world where capital efficiency, margin discipline, and LTV growth matter more than ever, assortment isn’t just an ops decision. It’s one of your highest-leverage strategic choices.