I’ve spent the last 15+ years investing, advising, and helping operate high-growth consumer brands across different sectors. Today, my team oversees $1B+ in gross merchandise value (GMV) across verticals — from beauty and personal care to supplement brands, from food & beverage to pet products, from DTC only to full omnichannel. Over the years, I’ve refined my perspective on what makes consumer brands truly investor-grade — that is, what makes a product-led business a productive asset capable of delivering return on invested capital (ROIC).

In this essay, I want to expand on that perspective and outline the framework we use at FinanceWithin to evaluate (and support) these brands.

Let’s get started.

What Makes a Productive Asset?

A productive asset is a company that can generate earnings or cash flow without requiring continual capital investment.

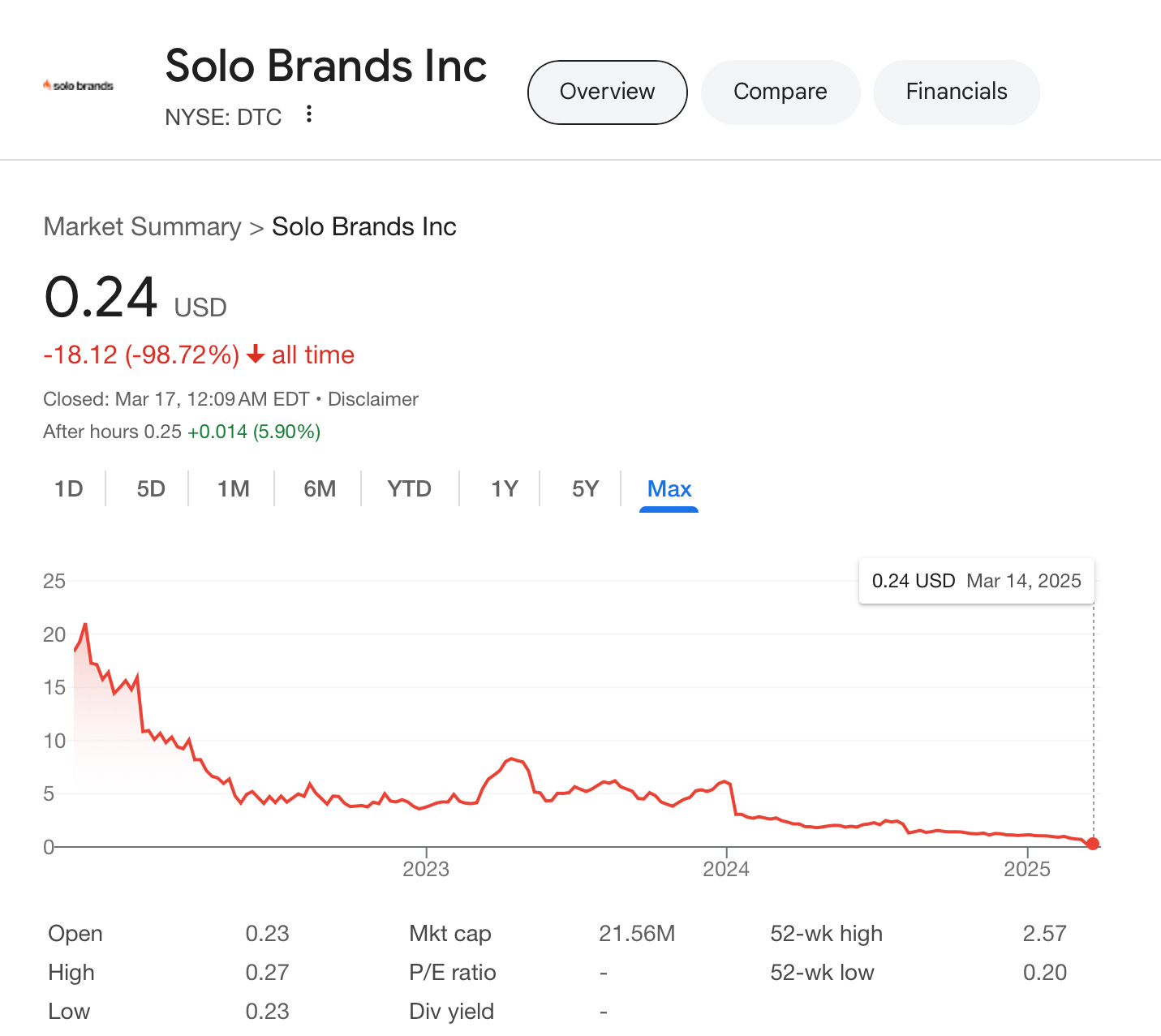

We lived through a zero-interest rate policy (ZIRP) environment for a long time. Really, since the 2008 financial crisis. Lower rates led to higher speculation. Which led to a focus on pushing for growth vs profitability. Which led to more companies raising continuous capital investment. Which led to inefficient use of capital and overspending. Which led to many consumer brands becoming unproductive assets. There are many examples of this.

Just a few DTC-first brands that are now public companies.

The tide has turned. Public market comps have reset. Private capital markets are being patient. LPs are asking better questions. The goalpost has moved — from pure growth, to profitability, and now, to a balanced appetite for sustainable growth and profitability.

So, what does this look like in practice?

At my firm, we’ve developed a simple framework we call “FinanceWithin’s Value Index” built around three pillars:

1. Growth

2. Profitability

3. Predictability

Let’s break each one down.

Growth: Momentum Matters

Growth is important — but not all growth is created equal. We want brands to show progressive, quality growth, not just top-line metrics.

Key signals of quality growth:

Gross and net revenue trends that are accelerating in a healthy, sustainable way.

Clear understanding and management of unit economics at various stages of growth.

Evidence that customer acquisition is becoming more efficient over time (i.e., improving marketing efficiency ratio, or MER).

A channel strategy that shows both depth (e.g., repeat purchase behavior, strong LTV) and breadth (e.g., ability to enter wholesale or international markets).

A marketing strategy that doesn’t rely solely on paid acquisition. Performance marketing is powerful, but organic demand, earned media, and brand equity are what build staying power. On a long enough time horizon, we want brands to market from their balance sheet. Goodwill matters when you’re a mature brand.

Digitally native brands lean heavily on paid media to scale early. That’s fine, and needed. But as you scale into high-8 figures in revenue, channel diversification becomes key. I’ve written about this previously (link here).

Use performance marketing as a megaphone. Your product and creative are the voice. If the voice is weak, it doesn’t matter how loud the megaphone is — people won’t listen.

Profitability: Disciplined, Not Frugal

Profitability is where the rubber meets the road. Unlike SaaS businesses, consumer brands deal with COGS, shipping, and variable marketing spend that make margins trickier to manage. Still, the best brands show discipline and a clear path to profitability early on.

Target benchmarks for investor-grade brands:

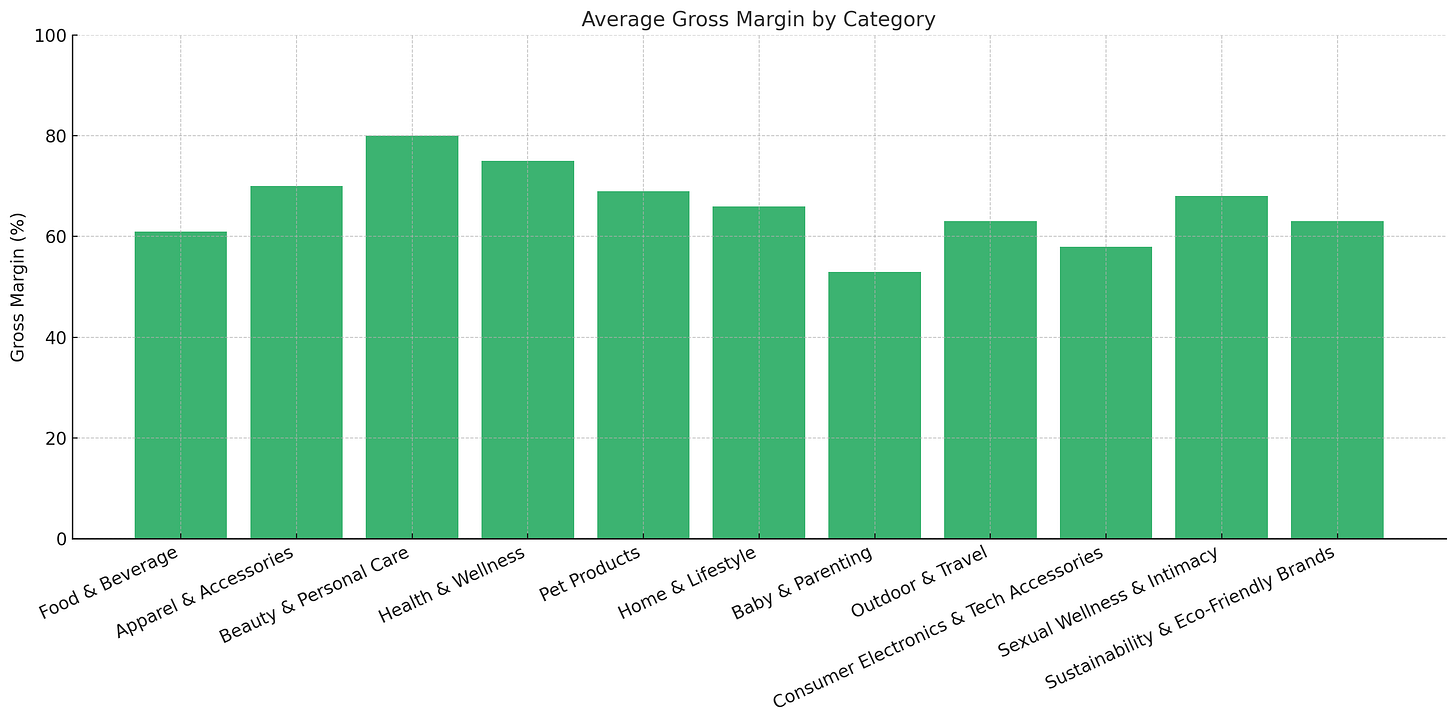

Gross margins: I’ve added a chart of standard benchmarks I see across a few different categories. This is not prescriptive and is designed to be directional. It varies from brand to brand and certainly, category to category. Beauty will have a completely different GM profile than food & bev.

Marketing spend: 15–35% of revenue (with improving efficiency over time)

Operating expenses (OPEX): Lean and deliberate

Net operating income (NOI): 10–15%+

Current ratio: 3x+ (elite)

Quick ratio: 2x+ (top notch)

Please see a detailed breakdown and bookends at the end of this letter.

For DTC-first brands, contribution margin is the critical metric. Marketing costs can be higher early on (up to 45–50% of revenue) and that’s acceptable if gross margin is strong. The goal should be to improve marketing efficiency over time, diversify the channel mix, and drive strong retention.

Ultimately, profitability is about capital allocation. The best brands know where every dollar goes — and they deploy it thoughtfully.

Predictability: Plan for Growth and Minimize Surprises

Predictability is about having deterministic forecasts that inform management guidance. The goal is to create consistency in cash flow, growth and align operational hygiene against it. Investors appreciate predictability because it reduces risk. Founders should, too.

Start with forecasting +/- 5% variance with your budget to actuals. Early-stage and high growth brands will typically see +/- 10% variance; it’s not uncommon, and that’s okay. Forecasting isn’t about being “accurate —” it’s about being deterministic vs indeterministic. Minimal variance provides clarity and creates alignment with key stakeholders.

Things I care about as a brand is exceeding growth expectations:

Channel diversification: DTC and wholesale, with measured expansion into international or retail.

Customer retention: Not just acquisition-focused. Brands with strong LTV/CAC ratios and customer value matrix is paramount.

Inventory discipline: Managing working capital efficiently and optimizing cash conversion cycles with a proper focus on merchandising and planning.

Liquidity planning: Brands must maintain healthy liquidity buffers to navigate seasonality, macro shocks, and market shifts.

Balance sheet strength: Avoiding over-leverage. Debt can be productive — but only when structured wisely and aligned with the brand’s cash flow profile.

Consumer brands aren’t tech companies. They don’t scale at the same rate of velocity. They take time. Often 2–3x longer to deliver strong liquidity outcomes.

When raising capital, founders need to look for strategic investors and capital allocators who have category experience because they will be able to align with their investors on this timeline. Mismatched expectations lead to misaligned strategy — and bad outcomes.

Brand Physics: Gravity is Real

Every brand faces gravity. Early wins can feel good: 1+1 = 2, 2+2 = 4. But at some point, marginal returns diminish: 3+3 = 5.

Brands hit a point where growth becomes harder, marketing becomes less efficient, and OPEX increases. Things I care about, and areas of discipline I want teams to focus on:

Tight cash flow forecasting (we use a 13-week model with clients)

Scenario planning for downturns

Capital allocation to key opportunities (with goal to drive higher ROIC)

Balancing growth initiatives with profitability guardrails

In short: Growth for the sake of growth can break the business. I remind myself of this: a great swimmer can still drown. Be strategic with planning desired future state of the business.

The All-Weather Strategy

Regardless of the macro backdrop — recession, pandemic, or boom times — investor-grade brands have common characteristics:

High gross and net revenue growth trends

Alignment on realistic growth timelines (especially with institutional capital)

Healthy gross margins and sustainable unit economics

Ability to scale organically (without relying solely on M&A)

Diversified acquisition strategy and strong retention

Optionality to verticalize the brand with manufacturing to increase margins

Working capital efficiency and proactive cash management

Conservative use of leverage and strong liquidity

Above all: Patience, discipline, and long-term thinking

Smart capital allocation isn’t optional — it’s a core skill that helps founders build great companies.

Visually speaking:

Closing Thought: Build Durable Companies

Most brands are marketing companies that sell a product. A productive consumer brand is more than just a great product or good at marketing — it’s a financially disciplined, strategically sound, and operationally excellent company. It’s a business that can thrive across market cycles.

When you build something durable and long-lasting, optionality will be there —whether it’s a strategic acquisition, PE platform exit, or potential IPO.

I used to think that you should “build to sell” and allow that to become a forcing function to build excellent operational hygiene. I approach it differently now. I want our clients and portfolio companies to focus on building durable assets because that will drive high ROIC, and therefore, maximize shareholder value.

Margins I Generally See:

Food & Beverage

Packaged Foods: 50-60%

Functional Foods: 50-70%

Alcoholic Beverages: 55-75% (spirits have higher margins than beer/wine)

Non-Alcoholic Beverages: 50-65%

Apparel & Accessories

Athleisure & Performance Wear: 60-75%

Casual & Streetwear: 55-70%

Luxury & Designer: 70-90%

Undergarments & Loungewear: 60-75%

Footwear: 50-65% (varies significantly by material and brand positioning)

Eyewear: 75-90% (one of the highest-margin categories)

Fashion Jewelry: 80-90%

Fine Jewelry: 60-80%

Luxury Watches: 50-75%

Beauty & Personal Care

Skincare: 75-90%

Haircare: 60-75%

Cosmetics & Makeup: 75-90%

Fragrance: 80-95% (one of the highest-margin categories)

Men’s Grooming: 65-80%

Health & Wellness

Supplements & Vitamins: 70-90%

Fitness & Recovery: 50-65%

Mental Wellness (CBD, nootropics, adaptogens): 75-90%

Pet Products

Pet Food: 25-55% (large variance here… frozen is will be lower, boxed and packaged will be higher)

Pet Health & Wellness (supplements): 70-90%

Pet Accessories: 60-80%

Pet Grooming & Hygiene: 60-75%

Home & Lifestyle

Home Goods & Decor: 60-80%

Kitchenware & Cookware: 50-65%

Bedding & Sleep: 40-75% (mattresses tend to be on the lower end)

Cleaning & Household Essentials: 50-70%

Baby & Parenting

Baby food: 40-60%

Diapers & Wipes: 25-55% (DTC and retail variance is key)

Baby Gear: 50-65%

Kids’ Apparel & Accessories: 55-75%

Outdoor & Travel

Camping & Adventure Gear: 50-70%

Luggage & Travel Accessories: 55-75%

Sexual Wellness & Intimacy

Sexual Health & Pleasure Products: 65-85%

Feminine Care: 50-70%