1-2-1: Inflationary Pressures

Bear markets, decision making heuristics, and 10 things to say to your children

This week’s letter at a glance:

Inflationary pressures will stay until 2023

WSJ: How to stop worrying and loving the bear market

3 heuristics for decision making - simple framework

10 things you need to say to your children immediately

Inflationary Pressures

We’re at the beginning of inflationary pressure, not the end. Below are some thoughts and predictions of what to expect rest of the year.

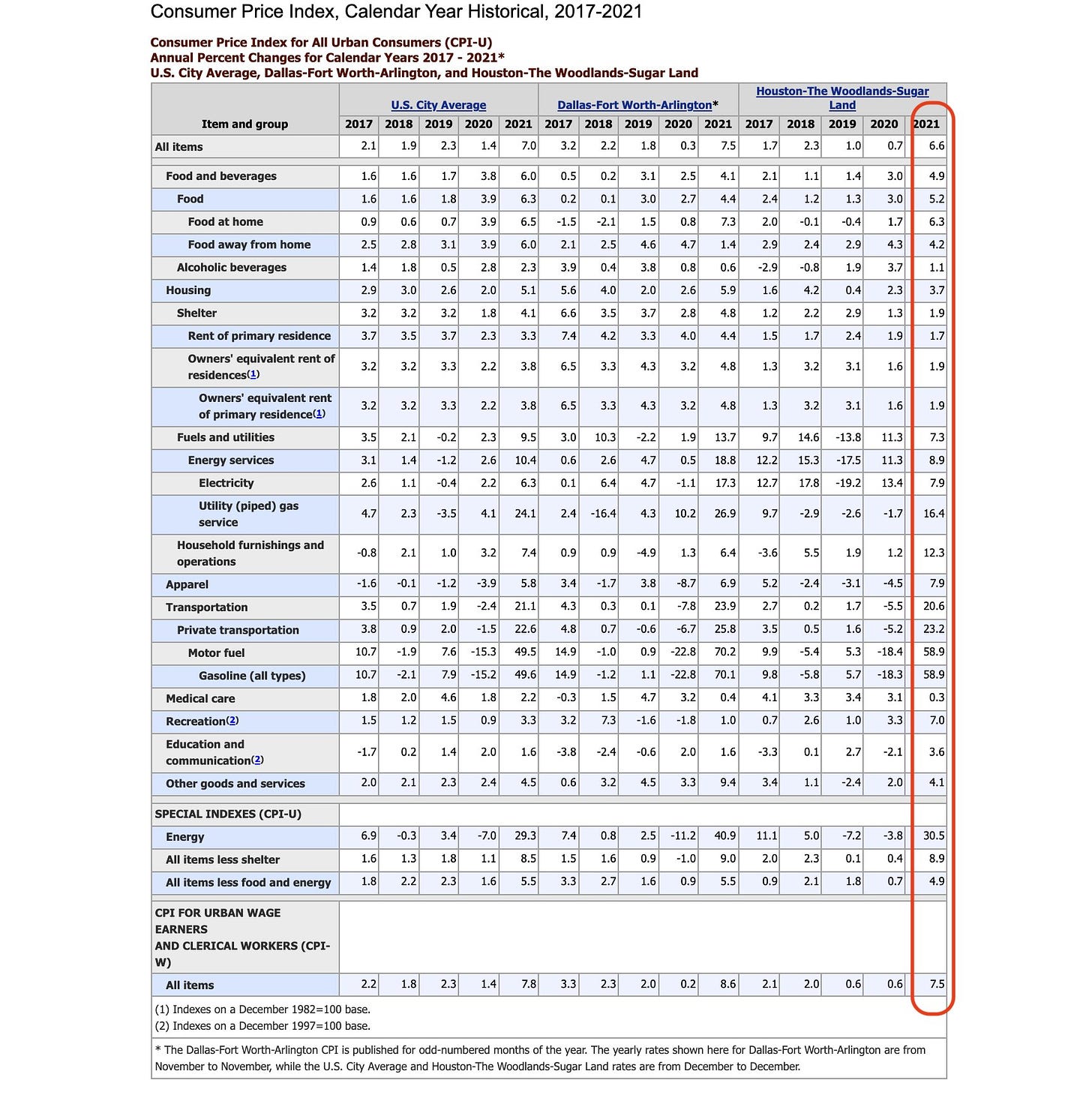

Consumer price index (CPI) is the measure of average changes in prices over time that consumers pay for goods and services. It effectively helps us measure inflation.

Historically, the US average inflation is ~2%. This is healthy and provides stability. Inflation and interest rates have a proportional relationship. When inflation rises, interest rates must also rise to combat inflation.

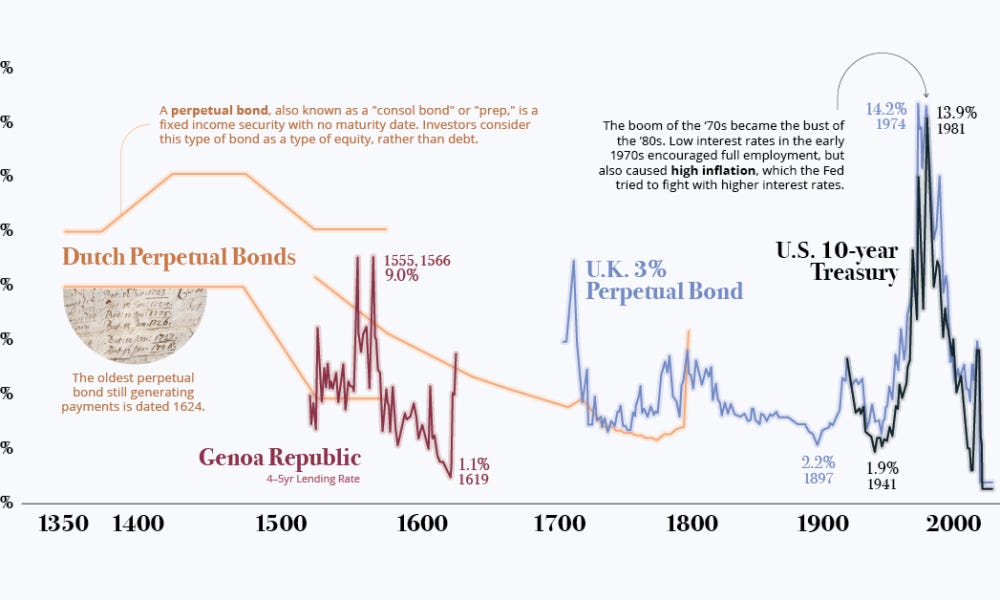

Over the last decade, we’ve seen the lowest interest rates we’ve ever experienced. In fact, we’re currently living in the lowest interest rate environment in the history of the world.

Some predictions:

CPI will run high (5-8%) until end of year 2022. The main way to control this is 7-8 rate hikes this year. 250+ bps each time.

The current Fed will be hesitant to increase rates too quickly.

Why?

Well, for one they’re operating with forecasts and have to make hard decisions on incomplete information. Secondly, institutions that normally create a lot of liquidity aren’t great at solving the problem the problem they created. You need a new administration to do that.

We don’t just have a supply constraint problem. We have too much liquidity. The current Fed may not have the temperament to tighten money supply fast enough. Tapering QE measures alone by raising rates gently won’t suddenly drop CPI to 2% again. It will take time.

The best course in history on this topic is early 1980s. Paul Volcker, who was then Fed chair, was relentlessly focused on fighting inflation by increasing rates. In early 1981, the Fed tightened money supply to a point where fed funds rate were approaching 20%.

People were taking out mortgages at a 14% interest rate! Can you imagine that in modern times?

By definition, inflation is too much money chasing too few goods. Let’s look at some examples.

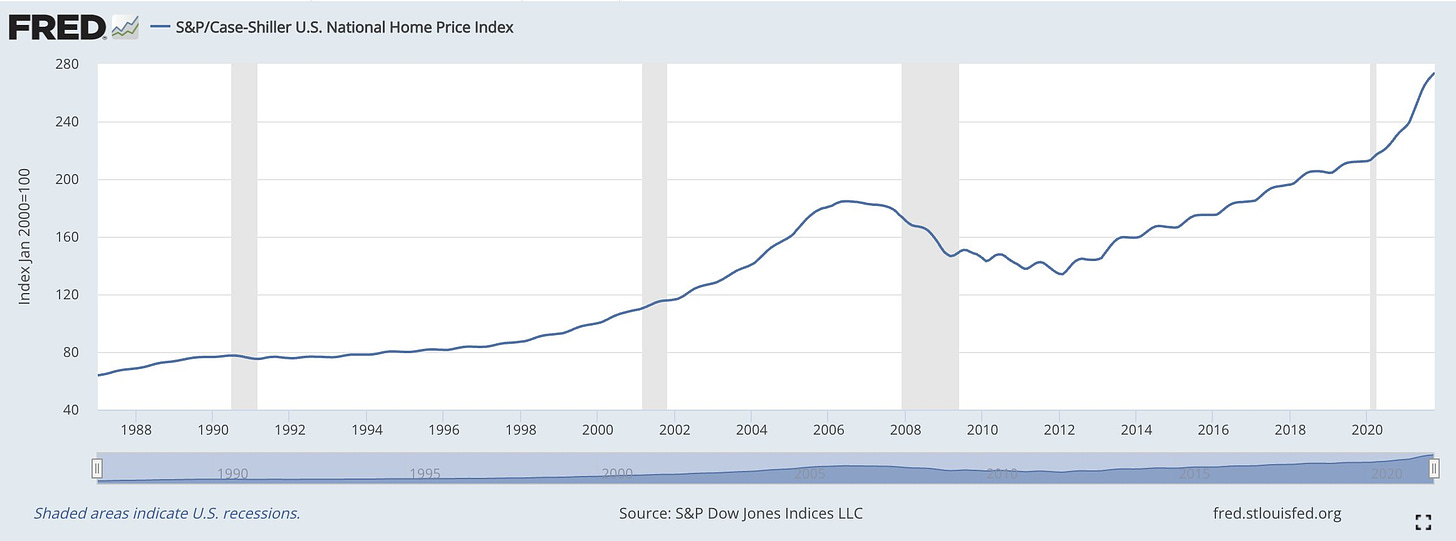

Starting with real estate:

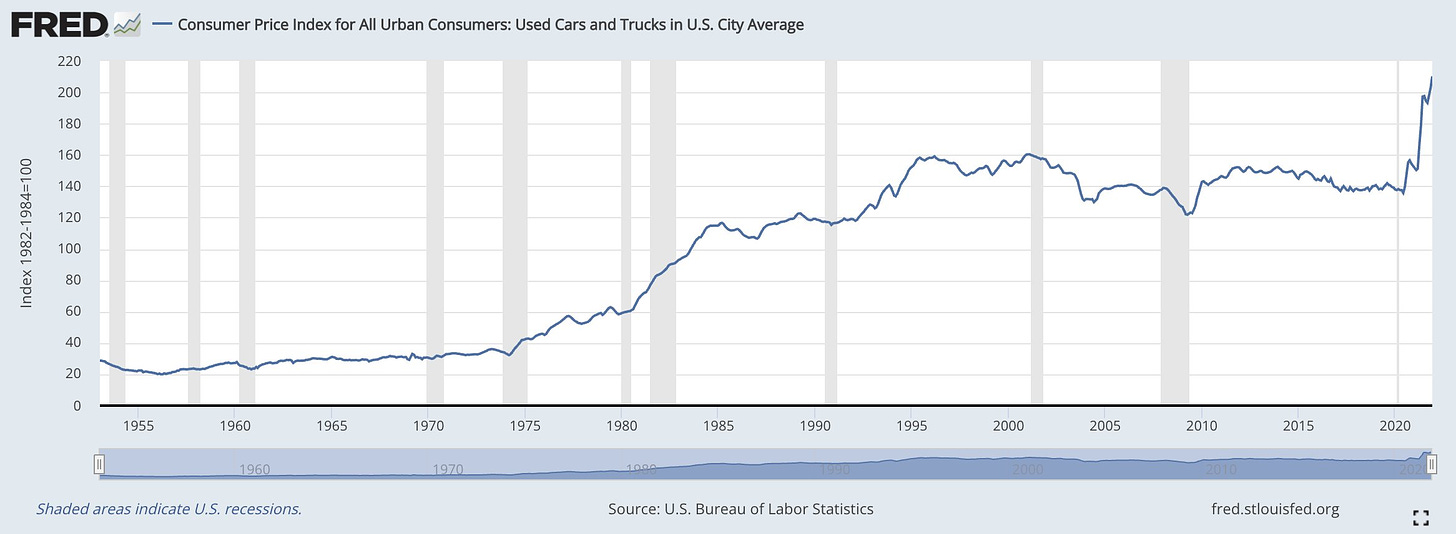

Used cars and trucks:

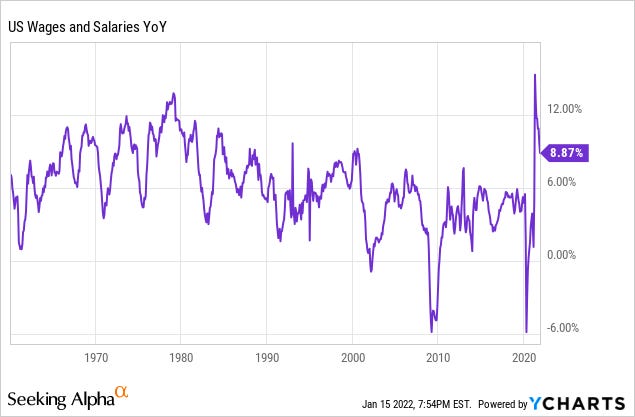

Hourly wages and salary is up meaningfully. We’re experiencing the largest spike in wages since 1979.

Generally speaking, higher wages means more demand. Which means price increasing if supply constraints are at play. Which impacts CPI.

Here are all the other relevant categories. Look at that increase for 2021.

There’s something buffet said in Berkshire Hathaway’s 2021 meeting that I can’t stop thinking about: “Interest rates basically are to the value of assets what gravity is to matter” - Buffet.

We’re experiencing this now. Asset prices for growth stocks have been impacted meaningfully over the last 3 weeks. Basically any company that’s not considered a productive asset (i.e. generating cash flow) will be impacted by interest rate hikes.

The fascinating thing is that the Fed hasn’t even raised rates yet. There’s an FOMC meeting Jan 25-26 and the following meeting is March 15-16. There’s a high likelihood that the first rate hike is around the corner. You can view FOMC meeting schedule here.

Lastly, bear markets are a great time to buy productive assets. The underlying companies are still good; just their prices fluctuate during these times. We used to live in “one stock market,” but today, we have “growth vs. value.” Value will outperform growth in a higher interest rate environment. Growth will outperform value in a lower interest rate environment; hence why growth equities have performed so well over the last decade.

2 Posts From Others

How I Learned to Stop Worrying and Love the Bear Market

5 min read

3 Heuristics for Decision Making — Naval Ravikant

7 min listen

One Twitter Thread Worth Reading

My daughter is ~16 months and she’s my #1 priority. This thread hits home. I’m actively working on all of these things David mentions and would strongly encourage all parents (and future parents) to give it a scroll.

That’s it for this week. Thanks for giving this a read. See you next weekend.